Tempus AI- $TEM: Building the Foundational Data Platform for AI Driven Medicine

Long term thesis

Executive Summary

Tempus AI is emerging as one of the most consequential platforms in modern healthcare by addressing a decades old structural bottleneck: the fragmentation of clinical, molecular, genomic, imaging, and outcomes data that prevents systematic translation of medical knowledge into actionable insights at the point of care.

Despite trillions of dollars spent annually on healthcare, decision making remains a significant issue where physicians rely on partial datasets, retrospective studies, and population level averages rather than individualized, data driven predictions. Pharma faces similar constraints, with trial design, patient matching, and target discovery slowed by siloed and incomplete real world data. Tempus exists to solve this problem at scale.

Through one of the world’s largest multimodal clinical data libraries, now exceeding 400 petabytes of de-identified data from over 40 million research records, including longitudinal outcomes from more than 60% of U.S. oncology patients, Tempus has built an AI native precision medicine platform that integrates diagnostics, clinical decision support, and pharma R&D into a self reinforcing ecosystem.

Each incremental test, partnership, and outcome strengthens the flywheel:

more data → better AI models → higher clinical and commercial utility → broader adoption → more data.

What began in 2015 as an oncology focused diagnostics company (founded by Eric Lefkofsky following his wife’s breast cancer diagnosis) has matured into a horizontal data and AI infrastructure layer for healthcare, with expanding relevance across oncology, digital pathology, cardiology, and international markets.

Importantly, the narrative has shifted. Tempus is no longer just a “promising AI story.” Execution has begun to validate the model through:

Sustained revenue acceleration

Expanding gross margins

Meaningful operating leverage

Milestone profitability (non GAAP adjusted EBITDA positive in Q3 2025 and slightly positive full year guidance)

Deep, embedded relationships with nearly every major oncology focused pharmaceutical company

The market continues to value Tempus primarily as a high growth diagnostics company while materially discounting its data platform, AI flywheel, and cross vertical optionality. This disconnect creates a compelling opportunity for long term duration investors like myself that are willing to tolerate volatility in exchange for platform compounding.

Key Metrics at a Glance

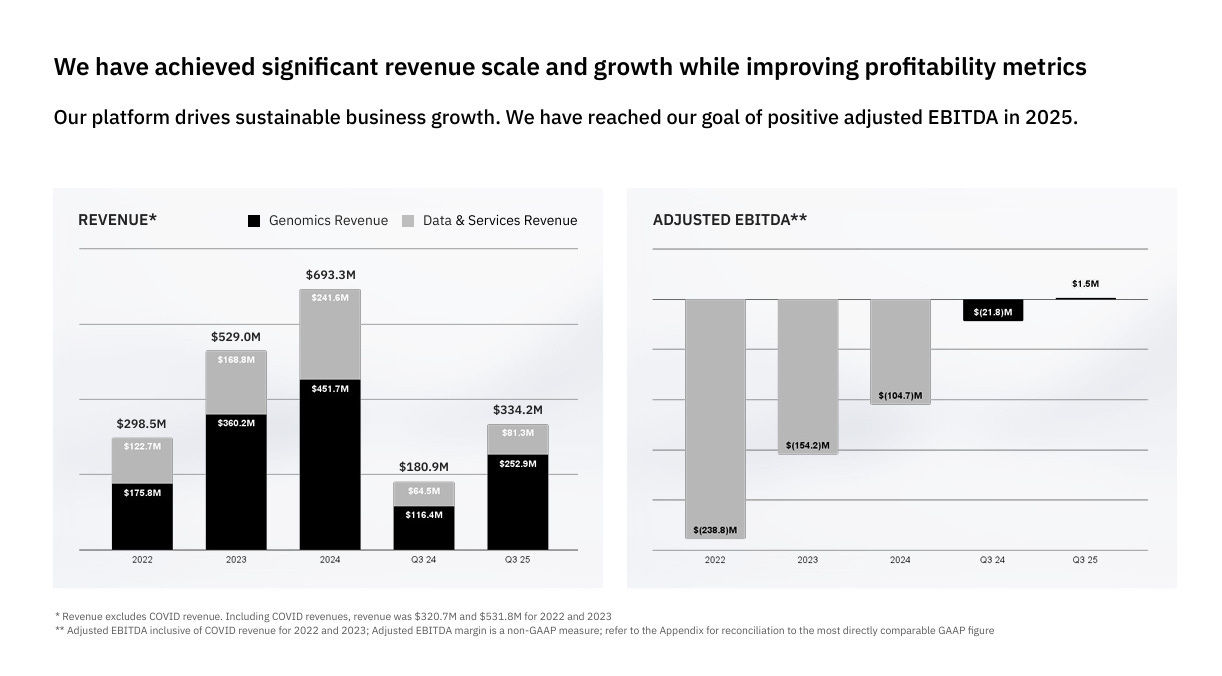

2025 Revenue Guidance: ~$1.265B (≈80% YoY growth from ~$693M in 2024), reaffirmed post-Q3

Q3 2025 Revenue: $334.2M (+84.7% YoY)

1) Genomics: ~$253M (+117% YoY)

2) Data & Insights: accelerating, high margin mix

Gross Margin: ~63–70% range (Non-GAAP gross profit $209.9M in Q3), expanding with mix shift

Adjusted EBITDA: +$1.5M in Q3 (first positive quarter); slightly positive full year expected despite ~$20M Q4 Paige integration drag

GAAP Net Income (TTM): ~-$200M, with clear trajectory toward breakeven by ~2026–2027

Data Assets:

1) 400 PB multimodal data

2) 40M de-identified patient records

3) ~7M digitized pathology slides (via Paige)

Market Capitalization: ~$12.1–$12.4B ($68–$70/share)

Analyst Consensus: Buy; average price target ~$80–$87 (high ~$105), implying 15–40%+ upside

A Personal Starting Point: From Skepticism to Conviction

My initial reaction to Tempus post IPO in mid 2024 was cautious. Healthcare AI is littered with companies that promised transformation but stalled under reimbursement friction, regulatory complexity, and slow clinical adoption. Eric Lefkofsky’s association with Groupon added further skepticism around capital discipline and long term execution in my view.

The early share price volatility reinforced concerns that Tempus might be another “great story, weak follow through” AI name.

What ultimately changed the view was not narrative refinement, but consistent operational evidence:

Sequential revenue acceleration quarter after quarter

Visible operating leverage as revenue scaled

Strategic, data accretive acquisitions rather than empire building

Regulatory progress with FDA cleared AI tools

First adjusted EBITDA positive quarter, followed by full year profitability guidance

Tempus crossed a critical threshold in 2025: proof of scalability. The platform began converting scale into margins, and data into monetization across multiple vectors.

The Core Problem: Healthcare’s Data Paradox

Healthcare generates enormous volumes of data, but value extraction remains poor due to:

Siloed systems (genomics, imaging, EHRs, outcomes)

Unstructured formats (clinical notes, pathology slides)

Limited feedback loops (outcomes rarely inform future decisions)

Regulatory and interoperability friction

As a result:

Physicians make decisions with incomplete context

Patients receive trial and error therapies

Pharma struggles with inefficient trials, suboptimal patient stratification, and long development timelines

This is not a data scarcity problem, it is a data integration and intelligence problem.

Tempus’ Solution: Multimodal AI at Scale

Tempus aggregates and harmonizes:

Next generation sequencing (tumor and liquid biopsy)

RNA expression data

Digitized pathology images

Clinical notes and structured EHR data

Longitudinal outcomes (treatment response, survival, recurrence)

These modalities are trained together, not in isolation. This is critical. Many clinically meaningful signals only emerge when genomics, imaging, and outcomes intersect.

Tempus then embeds insights directly into:

Physician workflows (diagnostic reports, risk stratification)

Health system decision making

Pharma pipelines (trial matching, biomarker discovery, real world evidence)

The result is a continuously learning system where real world outcomes refine future predictions.

The Flywheel in Practice

Scale Aggregation

Each new diagnostic test or data partnership expands a proprietary dataset with unmatched depth and longitudinal coverage.Multimodal Model Training

AI models trained across genomics, imaging, and clinical data improve predictive accuracy and clinical relevance.Deployment & Feedback

Insights influence care and trials, generating outcomes data that further refine models.Network Effects

More providers and pharma partners increase switching costs and deepen competitive moats.

This flywheel is difficult to replicate due to:

Regulatory barriers

Data access constraints

Long model training cycles

Embedded workflow integrations

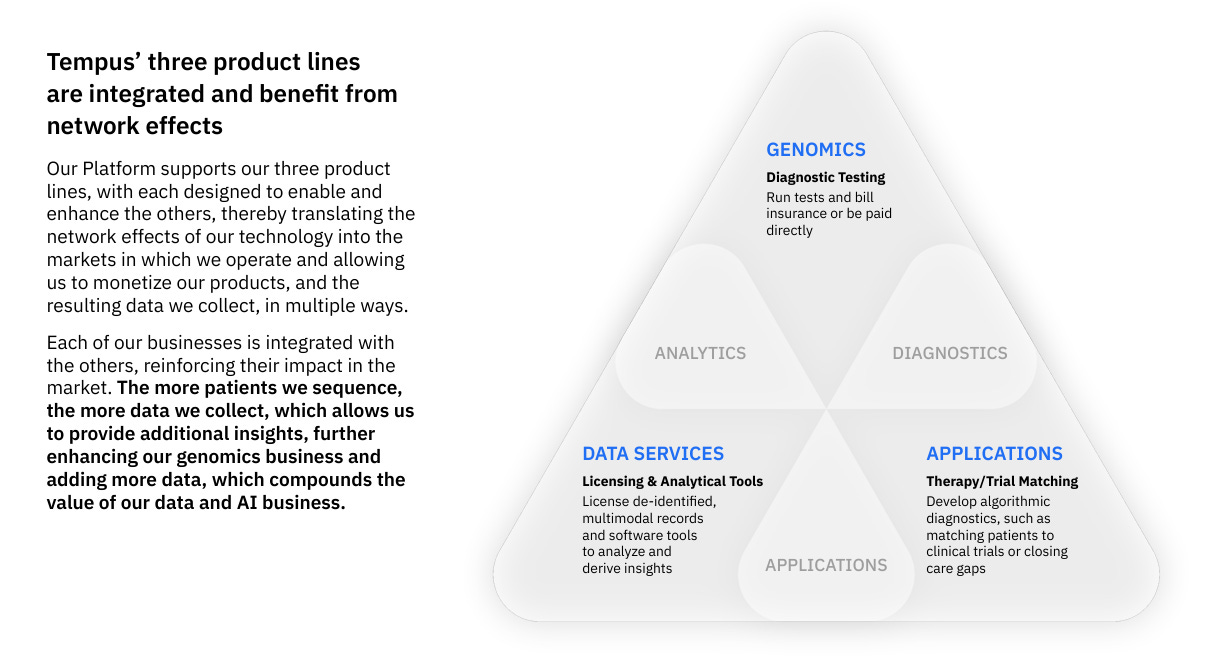

Business Breakdown

1. Genomics & Diagnostics (~80% of Revenue)

Tempus’ core engine includes:

xT (tumor profiling)

xF (liquid biopsy)

xR (RNA sequencing)

MRD assays

Annual test volume exceeds 500,000, with improving turnaround times and accuracy driven by AI enabled workflows.

Key dynamics:

Increasing reimbursement coverage

Deeper EHR integrations driving retention

Operating leverage as lab utilization improves

Management’s path to a $1B+ diagnostics run rate by 2028 seems credible given current growth and mix.

2. Data & Insights (~20%, High-Margin)

This segment licenses de-identified real world data to pharma for:

Target discovery

Trial design and patient matching

Regulatory submissions and evidence generation

Characteristics:

Multi year contracts

High switching costs

Margins materially above diagnostics

Minimal incremental capital requirements

Over time, this segment should drive disproportionate profit contribution.

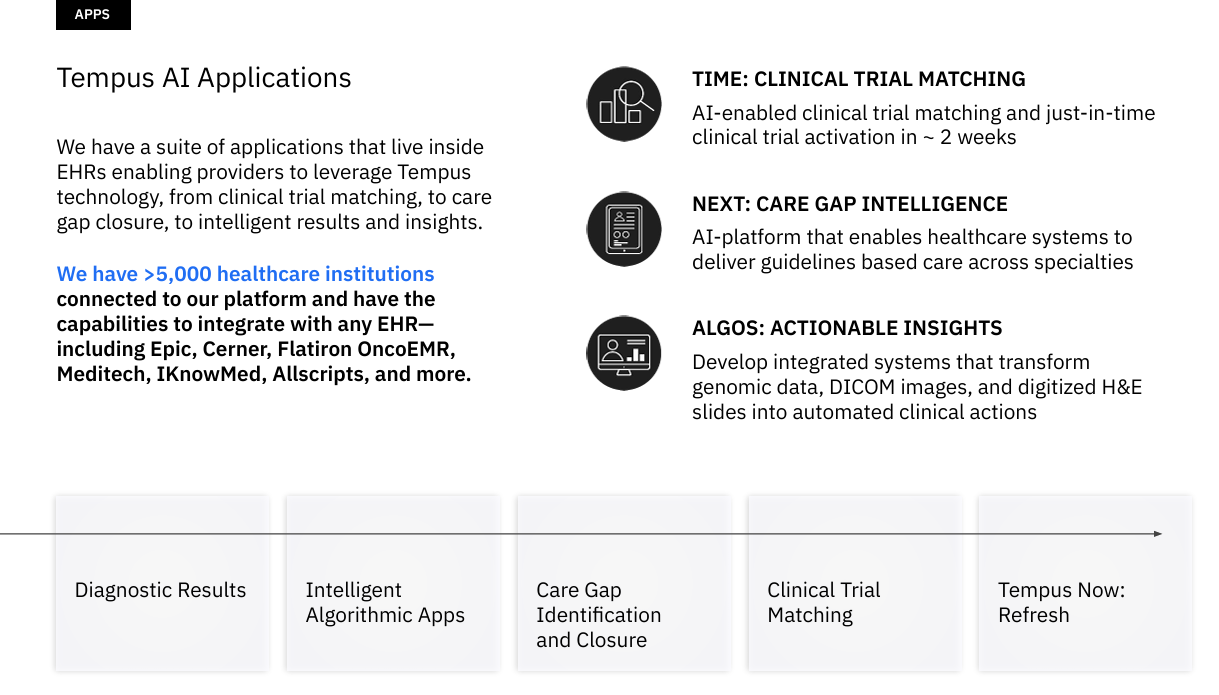

Applications Across the Healthcare and Life Sciences Stack

While Tempus is often described through revenue segments, the more durable way to understand the business is through its applications across the healthcare and life sciences ecosystem. These applications show how Tempus’ data and artificial intelligence capabilities are used in practice and where long term value is created. Importantly, the same data foundation and models support multiple applications, reinforcing platform economics.

At the point of care, Tempus supports clinical decision making by integrating genomic, molecular, and increasingly imaging based insights directly into physician workflows. Diagnostic reports emphasize interpretation and relevance rather than raw data, helping clinicians select therapies, assess risk, and identify clinical trial options. As longitudinal outcomes are incorporated, these tools increasingly shift from descriptive reporting toward predictive guidance, strengthening adoption and retention.

In oncology, Tempus applications extend beyond sequencing to enable precision therapy selection and disease monitoring. Tumor profiling, liquid biopsy, RNA analysis, and minimal residual disease testing are used together to guide treatment decisions and detect recurrence earlier. Linking molecular features with real world outcomes across a large patient base allows Tempus to identify clinically meaningful biomarkers while continuously improving its models. I am assuming HIMS 0.00%↑ will gravitate to this space eventually.

For pharmaceutical partners, one of the most immediate applications is clinical trial matching. Tempus continuously screens patient populations to identify individuals who meet complex eligibility criteria, improving enrollment efficiency and reducing trial timelines. These same capabilities support trial design, stratification, and evidence generation, addressing persistent bottlenecks in drug development.

Upstream, Tempus supports drug discovery and target identification by analyzing genomic, molecular, and pathology data alongside outcomes. Using large scale human data helps pharmaceutical companies validate targets earlier and reduce development risk. Tempus also plays a growing role in biomarker development and companion diagnostics, supporting programs from discovery through regulatory submission and commercialization.

Digital pathology represents a foundational expansion of the platform. Through the Paige acquisition this year, Tempus applies computer vision to whole slide images, improving diagnostic consistency and uncovering signals that enhance multimodal model training. Because pathology sits at the beginning of most oncology workflows, this application materially strengthens the overall platform.

In cardiology, early applications focus on risk detection using “electrocardiogram” based models cleared by regulators. While still early, this vertical expands Tempus beyond oncology and introduces large scale longitudinal data streams that broaden the platform’s relevance.

Finally, Tempus supports real world evidence generation for regulatory and post approval use cases. Longitudinal outcomes linked to detailed clinical and molecular data position the platform as a valuable partner for pharmaceutical companies navigating evolving regulatory expectations.

Taken together, these applications illustrate why Tempus functions as a platform rather than a single product company. Each use case reinforces the others by generating data, deepening relationships, and increasing reliance on the system. Over time, the applications layer is likely to drive differentiation, margin expansion, and durable competitive advantage.

Strategic Expansion Vectors

Digital Pathology (Paige Acquisition)

The 2025 acquisition of Paige added:

~7M annotated pathology slides

FDA cleared computer vision tools

Deep oncology partnerships

Pathology is a foundational modality —> nearly every cancer diagnosis begins with a slide. Integrating pathology data materially accelerates foundation model development.

Cardiology

FDA 510(k) clearances in 2025 for:

AI based atrial fibrillation detection

Low ejection fraction prediction via ECG

These tools are early stage but strategically important, offering:

Expansion beyond oncology

Additional longitudinal data streams

Broader provider adoption pathways

International Markets

Non U.S. revenue grew over 40% YoY in Q3 2025, driven largely by pharma data partnerships. International expansion is capital light and margin accretive. This is a significant opportunity going forward and success in this area would warrant a multiple expansion from today’s prices. The biggest hurdle I envision is regulatory issues.

Competitive Positioning

Tempus operates at the intersection of genomics, multimodal data integration, and AI driven clinical workflows, differentiating itself from three major categories:

1. Traditional Labs

Strengths: Scale, established infrastructure for diagnostic testing.

Limitations:

Minimal AI integration; data often remains siloed.

Lack of dynamic feedback loops for real time clinical decision-making.

Tempus Advantage: Goes beyond static lab testing by embedding AI into workflows and connecting genomic data with longitudinal clinical records.

2. AI Point Solutions

Strengths: Advanced algorithms for narrow use cases (e.g., imaging analysis).

Limitations:

Insufficient access to diverse, real world datasets.

Limited ability to integrate into clinical workflows at scale.

Tempus Advantage: Proprietary dataset of 40M+ patient records, including 1.1B medical documents and 8M+ de-identified research records, powering robust AI models across oncology, cardiology, and beyond.

3. Pharma Data Vendors

Strengths: Aggregated datasets for drug development.

Limitations:

No real time clinical feedback loops.

Data often lacks multimodal depth (genomics + imaging + EMR).

Tempus Advantage: Deep partnerships with top 20 pharma companies, enabling real world evidence (RWE) generation and clinical trial optimization through platforms like Tempus Lens and Tempus One.

Moat: Why Tempus Is Hard to Replicate

Tempus’ defensible moat is built on three reinforcing pillars that reminds me a lot of Lemonade:

1. Multimodal, Longitudinal Data

Proprietary library of 7.7M+ clinical and molecular records, growing through acquisitions (e.g., Ambry Genetics, Paige, Deep 6 AI).

Data spans genomics, imaging, pathology, EMRs, and outcomes, creating a holistic patient view.

Enables AIpowered precision medicine and predictive modeling for oncology, cardiology, and rare diseases.

2. Embedded Clinical Workflows/Tech stack

Integrated into 4,500+ hospital systems, making Tempus tools part of everyday clinical decision making.

Platforms like Tempus Hub and Lens deliver insights at the point of care, increasing stickiness and reducing switching costs.

Specialized Products and Tools:

- xT Platform — For extensive molecular profiling (tumor/normal + transcriptome sequencing) to identify targeted therapies and clinical trials.

- Hub — A desktop/mobile platform for ordering, managing, and reviewing tests/results.

- Lens — A research platform for scientists to query, analyze, and build cohorts from multimodal data using AI assistants.

- Next — An AI enabled care pathway platform to guide next steps in patient treatment.

- Imaging AI (enhanced by acquisitions like Paige for digital pathology) — For analyzing medical images, segmenting lesions, tracking responses over time, and automating criteria like therapy response.

3. Network Effects

Flywheel effect:

More tests → more data → better AI models → more adoption.

Each sequencing test adds genomic + clinical data, improving model accuracy for treatment selection and drug discovery.

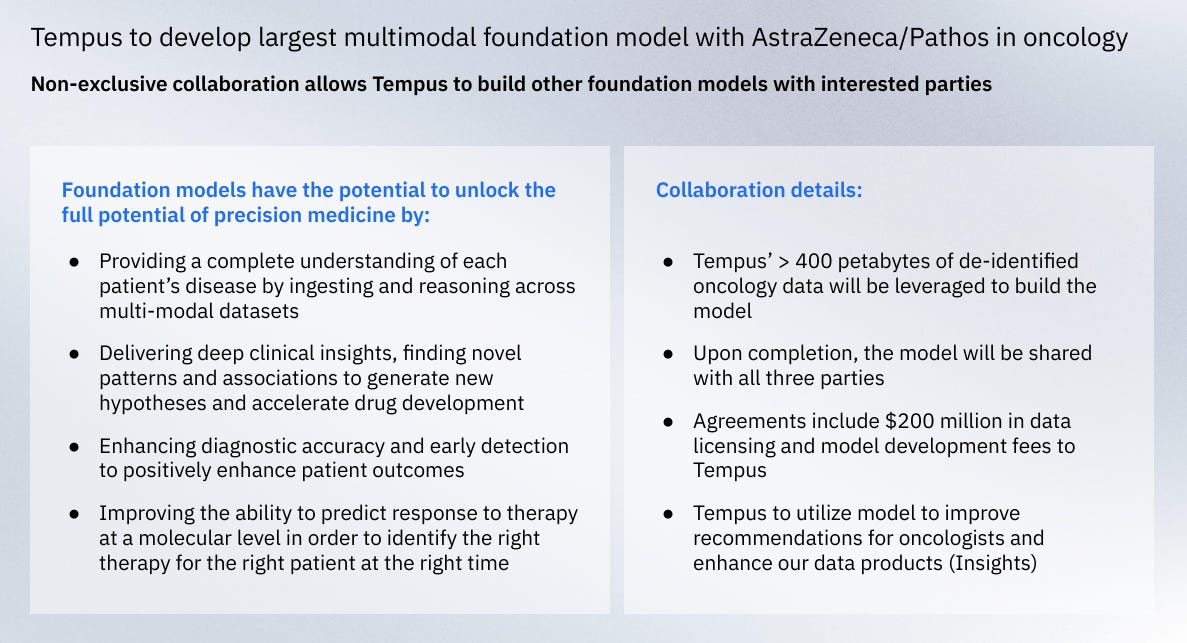

Partnerships amplify reach: $200M collaboration with AstraZeneca and Pathos AI for multimodal oncology models; $70M deal with GSK for trial optimization.

Risks & Bear Case: What Could Go Wrong

Despite the strength of the platform thesis, Tempus is not without real and meaningful risks. The biggest danger in a story like this is not that the long term vision is wrong, but that execution, timing, or capital structure friction interferes with compounding along the way.

Reimbursement and Diagnostic Economics

Tempus still generates the majority of its revenue from diagnostic testing, and that reality matters. While reimbursement coverage has steadily improved, particularly in oncology, pricing and utilization ultimately sit outside the company’s control. MRD assays and liquid biopsy are especially sensitive to payor behavior.

A slower than expected reimbursement ramp or adverse pricing decisions would directly pressure growth and margins in the core genomics segment. If diagnostics growth decelerates materially before the higher margin data business is large enough to offset it, operating leverage could stall and delay the path to GAAP profitability. In that scenario, the market would likely revert to valuing Tempus closer to traditional lab peers, at least temporarily.

Pharma Revenue Volatility

The Data & Insights segment is strategically important and economically attractive, but it comes with a different set of risks. Pharma contracts tend to be large, multiyear, and uneven in timing. Budget cycles, program reprioritizations, or slower renewal decisions can create short term volatility that obscures the underlying health of the business.

Even if long term demand remains intact, periods of contract lumpiness could pressure near term revenue growth and shake confidence. This matters because the platform multiple depends on consistent evidence that the data business is scaling predictably and becoming a durable profit engine.

Platform Execution Beyond Oncology

Oncology is where Tempus has its deepest data, strongest relationships, and clearest product market fit. Expansion into digital pathology, cardiology, and other verticals is strategically sound, but execution risk increases meaningfully outside the core.

If these newer verticals take longer to scale, require more capital than expected, or fail to achieve regulatory and commercial traction, the market may discount cross vertical optionality more heavily. In a bear case, Tempus risks being viewed as an excellent oncology company with limited horizontal expansion, rather than a true healthcare data platform.

Competition and Data Access

Tempus’ moat rests on proprietary multimodal data and deep workflow integration. While this is difficult to replicate, it is not immune to pressure. Large incumbents have capital, distribution, and regulatory expertise, while cloud and EHR vendors control important parts of the healthcare data stack.

Any meaningful restriction on data access, interoperability, or de-identification standards could slow dataset growth and weaken the AI flywheel over time. Even modest friction here would matter, because the platform narrative depends on continuous data accumulation and feedback loops.

Capital Structure and Dilution Risk

Perhaps the most underappreciated risk is dilution. Tempus has done a good job refinancing expensive debt into low cost convertible notes, but leverage remains elevated relative to equity, and the business is not yet consistently cash flow positive.

The $750 million convertible issuance at a ~$84 conversion price limits near term dilution, but it does not eliminate it. If the stock performs well, dilution becomes real. If performance disappoints and cash flow lags, the company could be forced to raise additional capital at less favorable prices, particularly if macro conditions or healthcare sentiment deteriorate.

In a true bear scenario — slower growth, margin pressure, and delayed profitability — equity dilution could compound valuation compression. Even a strong business can deliver poor shareholder returns if share count expansion offsets operating progress.

How the Bear Case Plays Out

Put together, the bear case is not about Tempus failing outright. It is about a mismatch between ambition and timing. Slower reimbursement progress, uneven pharma revenue, delayed scaling outside oncology, and dilution risk could keep the company in a “prove it” penalty box for longer than investors expect.

Under that outcome, revenue growth could fall into the mid teens, margins could stagnate, and the market could value Tempus more like a high growth diagnostics company than a data platform. In that environment, downside to the stock would likely come less from fundamentals collapsing and more from multiple compression and share count expansion.

Why the Risk Is Acceptable (If You’re Patient)

The reason these risks are tolerable, in my view, is that most are timing and execution risks rather than structural flaws. The data assets are real. The customer relationships are deep. The regulatory progress is tangible. And management has shown increasing financial discipline.

For long term investors like myself, the key is position sizing and expectations. Tempus is unlikely to compound in a straight line. Volatility, drawdowns, and periods of skepticism should be expected. The bet is that over a multi year horizon, the platform converts scale into durable cash flow before dilution meaningfully erodes ownership.

Valuation & Outlook

Valuation is difficult at this stage of the company’s journey. It definitely isn’t cheap but it isn’t expensive if they hit their objectives. It will come down to sustaining a revenue CAGR of 20%+ and gaining operating leverage. I want to touch base on their balance sheet quickly as this could pose a risk in the future if not managed correctly.

Where Tempus Stands Financially

Tempus has built a strong foundation, but it’s carrying a fair amount of debt as part of its growth strategy.

Here’s the big picture:

Assets: About $2.3 billion, which includes a healthy cash cushion of roughly $760 million.

Liabilities: Around $1.8 billion, most of it tied to long term debt.

Equity: Just over $500 million, so the company is still heavily leveraged.

Debt to Equity: High at about 2.5x but improving as operations scale.

Liquidity: Solid in the short term thanks to strong cash reserves.

Convertible Debt – What’s Going On?

Tempus recently issued $750 million in convertible notes to replace older, more expensive loans. Here’s why that matters:

Interest Rate: Just 0.75%, which is very low compared to traditional debt.

Maturity: 2030, giving them plenty of breathing room.

Conversion Price: $84.19 per share (a premium over the stock price at the time), so dilution risk is limited.

Capped Call: They added a hedge to protect against too much dilution if the stock price skyrockets.

Use of Funds: Paid down older loans, set aside cash for growth, and invested in AI and acquisitions.

Why This Is Smart

By swapping high cost loans for low interest convertible notes, Tempus:

Cuts interest expenses.

Extends its debt timeline.

Keeps flexibility for future investments.

Protects shareholders from excessive dilution.

At ~10–11x 2025 revenue, Tempus is priced as a high growth diagnostics company, not as a data and AI platform with expanding optionality. Looking at the conventional P/E, P/S metrics is usually a mistake with a company like Tempus.

From a 10 year outlook a DCF, this is what my view looks like…..

Base case assumptions:

~25%+ revenue CAGR

15%+ long-term FCF margins

4% terminal growth

10% WACC

→ Intrinsic value ~$95/share

Bull case (stronger data monetization, regulatory wins):

→ $120–$150+

My more modest targets (~$80–$87) support near term upside even without multiple expansion.

My final thoughts

Tempus AI is building the data backbone that modern precision medicine has been missing. They’re moving from big promises to real, tangible proof, turning scattered healthcare data into a smart, ever improving system that actually helps doctors deliver better care and speeds up breakthroughs in research. In a trillion dollar+ healthcare industry that’s screaming for AI transformation, Tempus stands out as a solid long term bet in my opinion. The platform has some real strengths:

Huge structural data edge —→ one of the biggest collections of clinical + molecular data out there, plus multimodal real world info and connections to thousands of hospitals and labs.

Solid regulatory track record — FDA clearances on AI tools (like their ECG-Low EF one), consistent submissions, and proven diagnostic workflows.

Growing operating leverage — as they scale the high margin data/AI side alongside genomics, we’re seeing adjusted EBITDA improve and a realistic path to GAAP profitability in the next few years.

Long runway ahead — network effects keep compounding, more biopharma deals, AI expanding into new areas, and a massive market in precision medicine.

Right now (as of early January 2026), the stock’s trading in the high $60s to low $70s—around $67–69 lately. Normally I’d wait for a better entry, but honestly, if you’re thinking years ahead, the difference between buying in the $50–70 zone versus holding out for a bigger dip probably won’t move the needle much on the overall return, assuming the story plays out. That said, you really have to believe in the long term vision and be okay riding the volatility. I’d suggest taking it easy: dollar cost average in gradually instead of going all in at once.

This is not financial advice. Do your own homework and make sure it fits your risk tolerance. Things in this space can shift fast with news, regs, or execution.

Excellent write up, I enjoyed it and agree that Tempus is building a formidable moat.

Have you looked at Personalis ($PSNL)? They are Tempus' diagnostic testing partner for the MRD tests. Extraordinarily compelling business with an asymmetric set up imo. I wrote up Personalis here:

https://www.securityanalysis.ai/p/psnl-cancer-diagnostic-company-on?r=v3k9&utm_campaign=post&utm_medium=web